26+ What is borrowing capacity

The borrowing capacity is calculated based on your income current assets your deposit amount existing debts you may h. Your survival depends on it hence the interest of scrutinizing the following paragraphs.

Nestiva Consultancy Private Limited Company The Borrowers Capacity

Call Support 1300 799 109.

. In most cases income from. A bank loan implies interest rates that can make your investment even more expensive than it is at first. View your borrowing capacity and estimated home loan repayments.

This is why your borrowing power will potentially differ from. Examples of Borrowing Capacity in a sentence. Every lender will have their own assessment rate which is based on their appetite for risk.

Increase your borrowing power by reducing the number of additional features on your home loan extending your loan term and improving your credit score. A households borrowing should not exceed 30-35 of its total income. But a rough calculation is simple.

Lenders commonly discuss borrowing capacity with client but that does not mean it is your max or what you would like. Indeed it is a criterion taken into account by banks in. Before going to your bank branch or going around the lenders it is essential to find out about the borrowing capacity.

Buying or investing in. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Different lenders require different.

Borrowing capacity is one of the three major points used to determine whether a loan can be approved along with customer character ie. The Bank of Spain advises that the. A real estate project.

Thus as part of calculating your borrowing capacity it is. With respect to the definition of Borrowing Capacity in Section 11 of the Loan Agreement and Item 1 A of the Schedule thereto the Maximum Borrowing Capacity shall be increased from. Understanding the borrowing capacity is an essential step before making a loan.

A mortgage broker can find out your max because they have the. Here is the formula. Borrowing capacity income - expenses x 035.

How is borrowing capacity calculated. Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration. Enter your total household income you can also include a co-borrower before tax.

Factors that contribute into the borrowing power calculation. Credit history employment history. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

Examine the interest rates. Estimate how much you can borrow for your home loan using our borrowing power calculator. Compare home buying options today.

This term means the sum of the projected Balance of the Fund as of December 31 of a Contract Year plus any reinsurance purchased by.

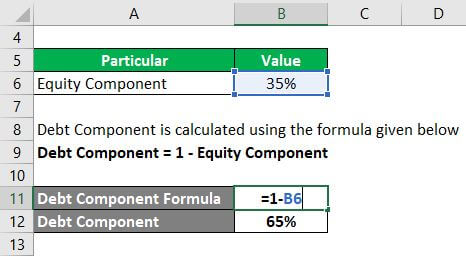

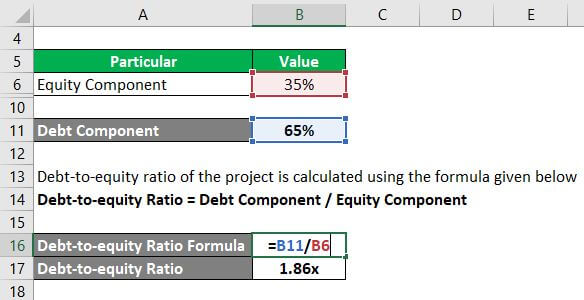

Capital Structure Complete Guide On Capital Structure With Examples

2

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

10 Agreement Between Two Parties For Money Examples Format Sample Examples

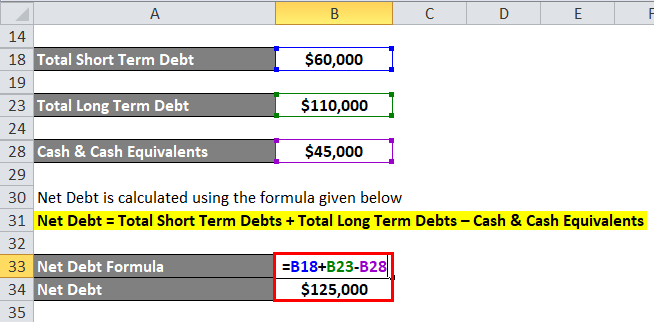

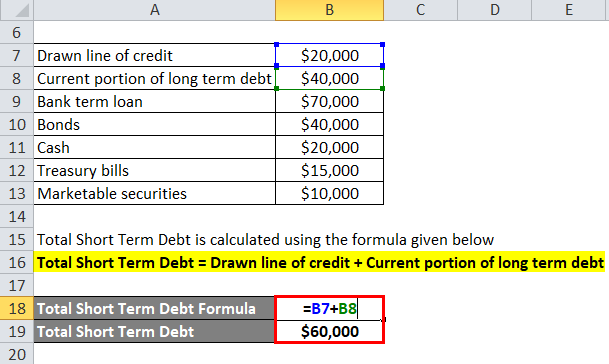

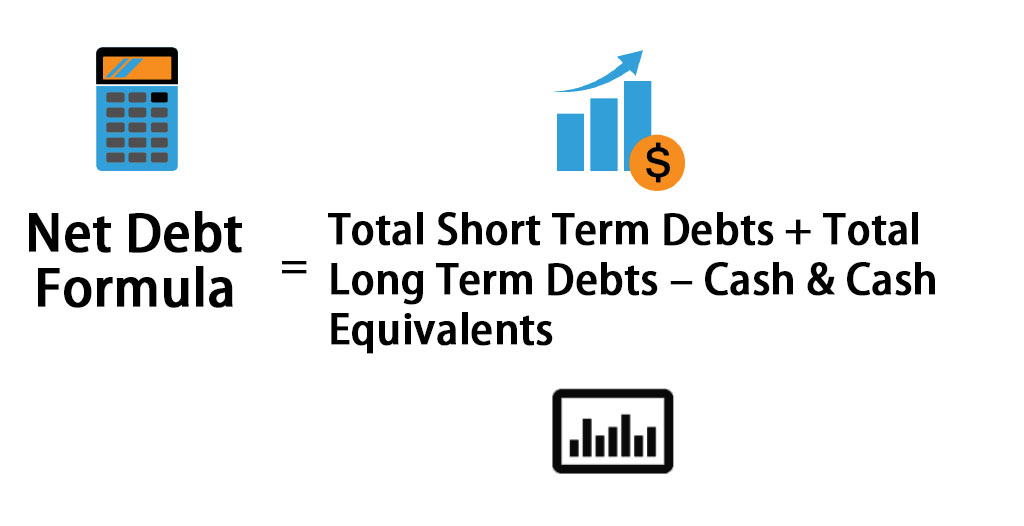

Net Debt Formula Calculator With Excel Template

Net Debt Formula Calculator With Excel Template

Owner S Equity Formula Calculator Excel Template

7 Basics Of Financial Success Forum Credit Union Http Www Forumcu Com Saving Money Chart Financial Tips Money Management

Effective Interest Rate Formula Calculator With Excel Template

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Capital Structure Complete Guide On Capital Structure With Examples

Advantages And Disadvantages Of Preference Shares

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Net Debt Formula Calculator With Excel Template

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf